tax payment forgiveness program

DE HI and VT do not support part-yearnonresident individual forms. This is a tax debt.

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Tax forgiveness doesnt get rid of your debt completely.

. Provides a reduction in tax. Most state programs available in January. Web Form 656s you must submit individual and business tax debt Corporation LLC Partnership on separate Forms 656.

Then you have to show to. Web In order to receive an IRS Tax Obligation Forgiveness Program you initially have to owe the IRS at the very least 10000 in back taxes. You can also apply for the IRS debt forgiveness program if youre self.

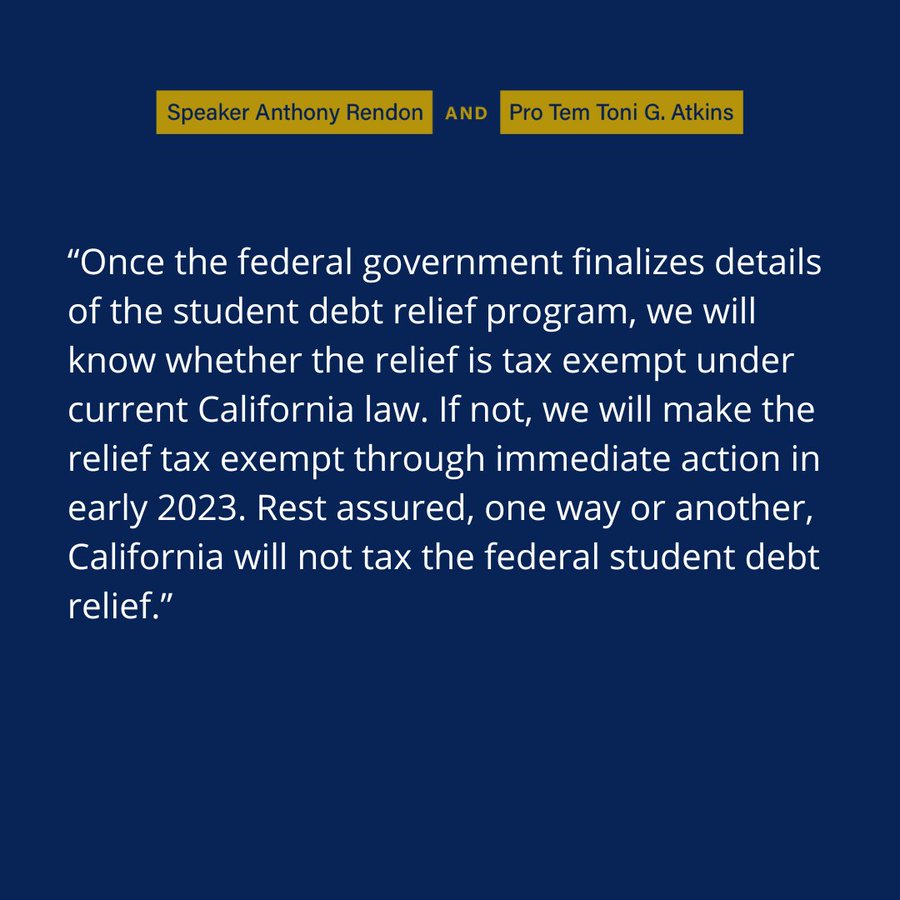

Web A total tax debt balance of 50000 or below. Web IRS debt forgiveness is for those with a debt of 50000 or less. If the Supreme Court makes a final ruling on the program.

Web The IRS Fresh Start Program allows for tax forgiveness credits against your earned income to help reduce the overall amount of money you owe in taxes every year. Web Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Web The exact date that the federal student loan payment and interest pause ends is somewhat complicated.

Instead the tax forgiveness programs assess how much you can. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married. Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the.

A total income below 100000 or 200000 for married couples A recent drop in income of over 25 for self-employed individuals. Web State e-file available for 1995. The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more.

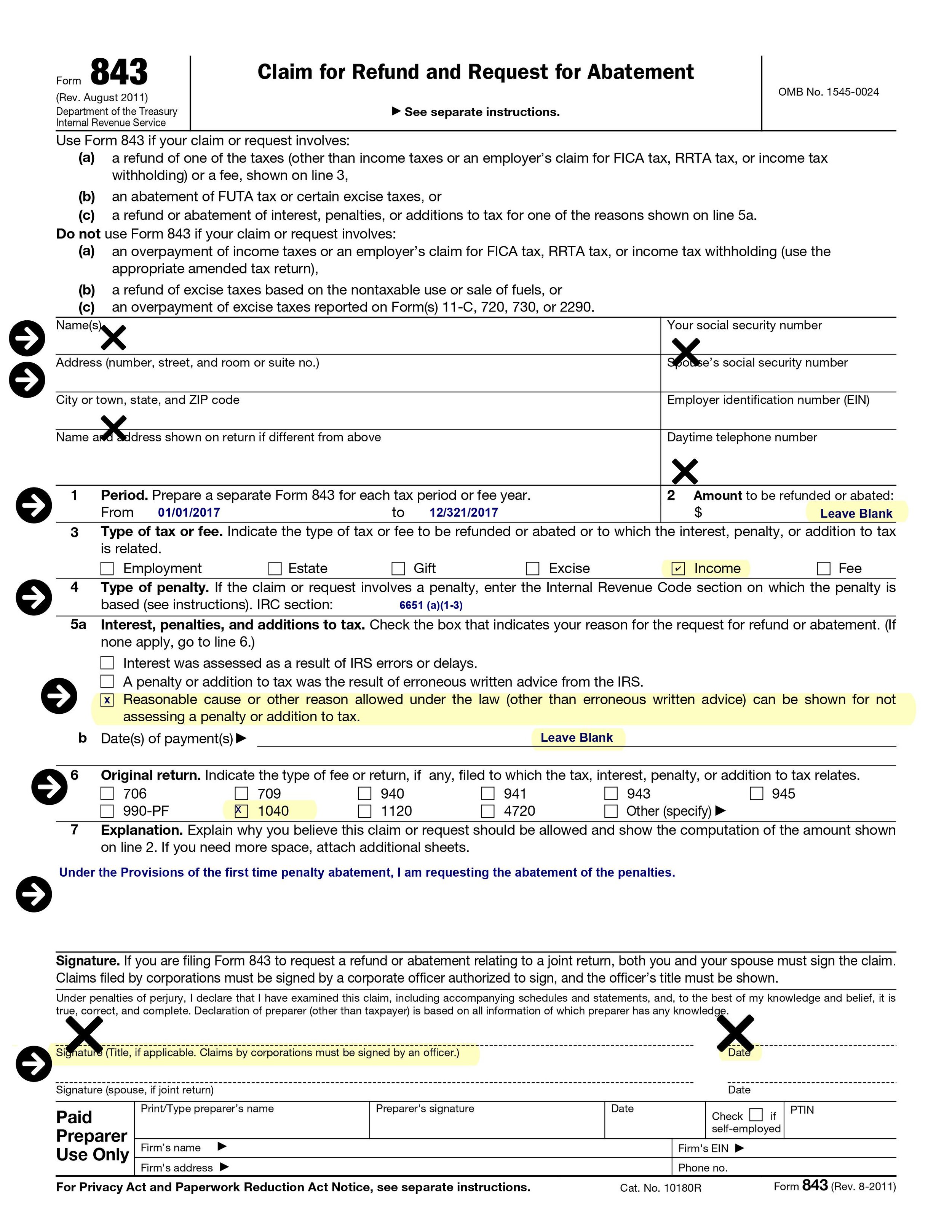

Web The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. Web First-time penalty abatement is another one-time forgiveness program that allows the IRS to waive all fines and penalties you owe. Generally if you borrow money from a commercial lender and.

The qualification requirements are. Web A taxpayer that gets into IRS tax forgiveness services with a reputable company like Community Tax will be able to start removing the stress and challenges that accompany. Web What Is Tax Forgiveness.

Web What Is The Debt Forgiveness Program. Web Does the IRS Have a Debt Forgiveness Program. Web However if we have a valid reason for not making the payment there are a few IRS tax debt forgiveness programs.

Web Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples. 205 application fee non-refundable Initial. The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find.

Web Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child.

Everything You Need To Know About Irs Tax Forgiveness Programs

How To Remove Irs Tax Penalties In 3 Easy Steps The Irs Penalty Abatement Guide Get Rid Of Tax Problems Stop Irs Collections

Student Loan Forgiveness Could Cost 2 500 Per Taxpayer Research Finds

If Student Debt Relief Passes Will Loan Forgiveness Wipe Out Your Tax Refund Cnet

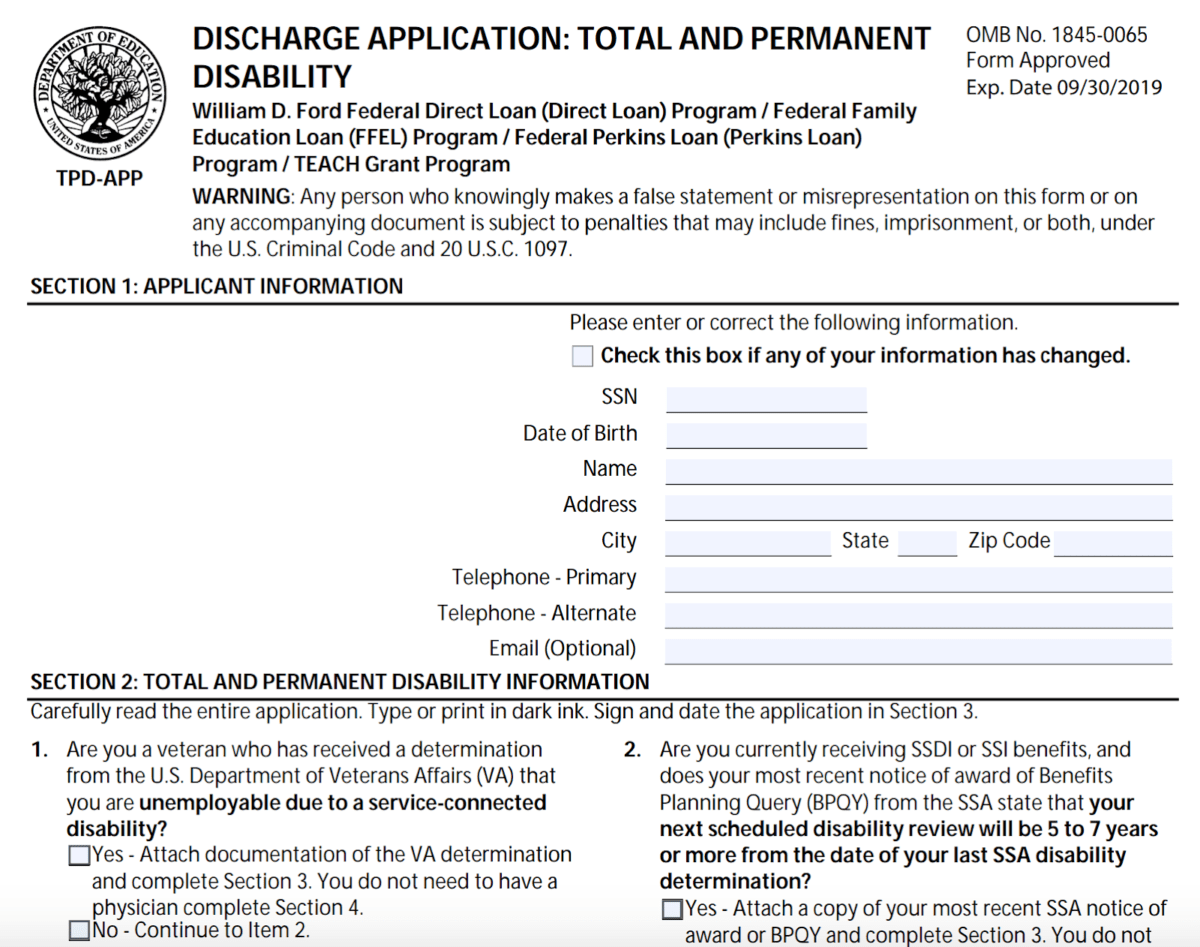

Student Loan Forgiveness Forms Student Loan Planner

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Tax Debt Forgiveness Program Irs Tax Relief Programs

Calameo Three Ways To Settle Or Resolve Your Tax Debt Advance Tax Relief

Taxes And Student Loan Forgiveness Updated 2021

Irs Payment Plan Everything You Need To Know Community Tax

Irs Debt Forgiveness Program Tax Group Center

Irs Tax Payment Plans Installments Or Offer In Compromise

Tax Debt Relief Real Help Or Just A Scam Credit Karma

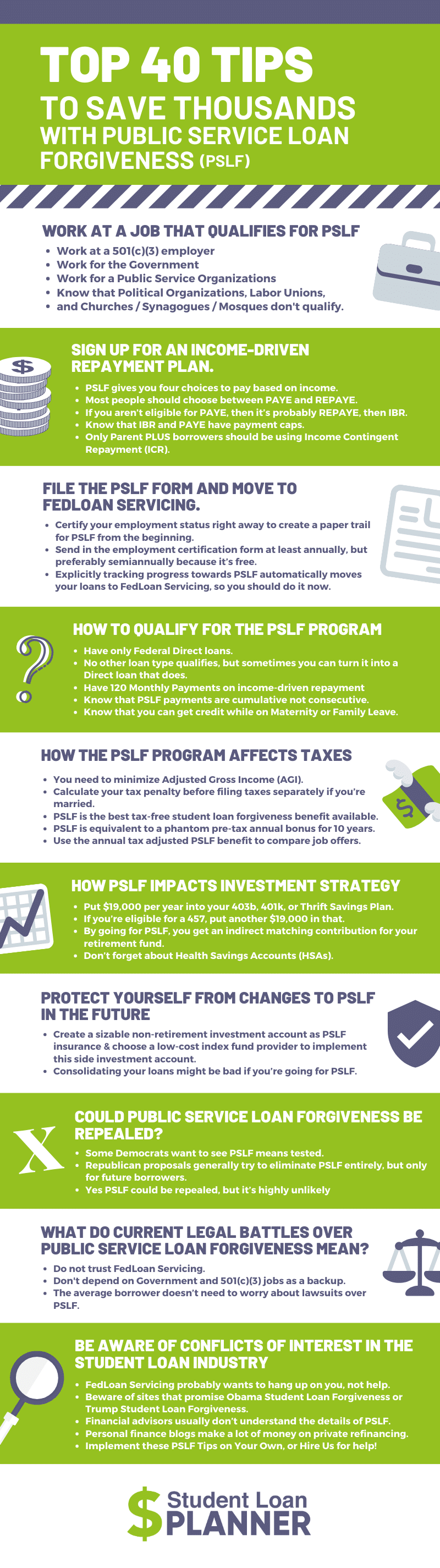

Public Service Loan Forgiveness 40 Tips To Save Thousands

The Irs Tax Debt Forgiveness Program Explained

Irs Back Tax Help Resolution Resources For Tax Help Relief

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)